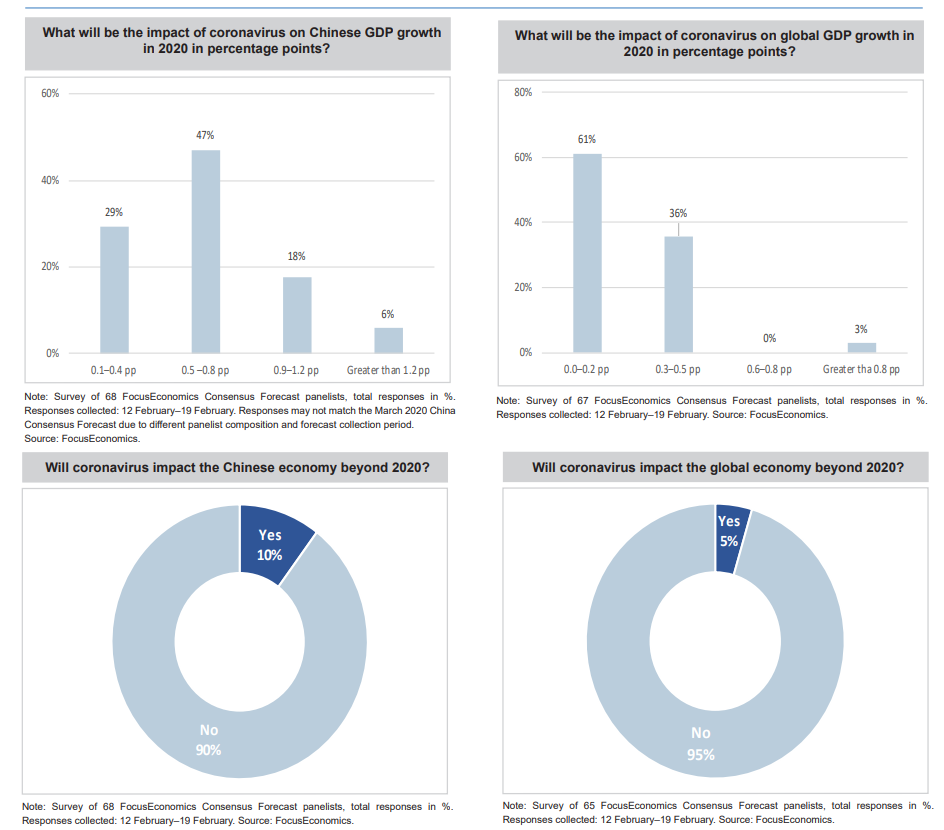

• Our panelists expect the coronavirus will significantly hit China’s GDP growth this year, notwithstanding government stimulus. Almost half the panelists surveyed project the virus to subtract 0.5-0.8 percentage points from Chinese growth.

• The impact on the global economy should be milder: Most panelists see a 0.0–0.2 percentage-point reduction in global growth, with the impact likely concentrated in H1. However, risks are skewed to the downside, and the impact could well be larger if the spread of the virus outside China continues.

• There is still a notable divergence in panelists’ views, reflecting the inherent difficulties in forecasting the duration and extent of the epidemic. • Our panelists judged that South-East Asian countries would suffer the largest economic fallout, due to close economic ties with China and geographical proximity increasing the risk of contagion.

• For this reason, Japan is likely to be the G7 nation hardest hit by the epidemic. However, the recent outbreak in Italy raises the risk of a larger economic impact there and a spread to neighboring European countries.

• The vast majority of panelists do not see the economic impact of coronavirus persisting beyond 2020.

“The global economy will feel the ill effects from China’s economic problems through three principal channels. Chinese tourism and business travel to the rest of the world has already stopped. Major tourism destinations across the globe are feeling the effects, although they are most pronounced throughout Asia. Second, the global manufacturing supply chain is disrupted, as China is at the end of many of those chains. Southeast Asia is especially vulnerable to this disruption, although manufacturers throughout the world, including in the U.S. and Europe, will be affected. Shortages of some goods will likely result this spring. Finally, emerging markets, particularly in Latin America and Africa, will also soon feel the ill-effects of the slump in commodity markets, since China will purchase less oil, copper, soybeans and other commodities.”

- Xu Xiao Chun, economist at Moody’s Analytics

Report from Focus Economics

Edited for Chaganomics by Zermat Research