Mounting headwinds will weigh on global growth further down the road...

REAL SECTOR

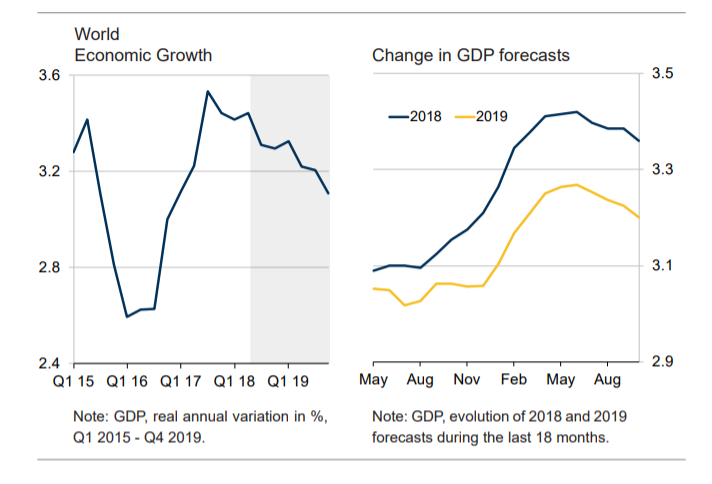

Mounting headwinds will weigh on global growth further down the road Global economic growth appears to be losing some steam in Q3 following Q2’s strong result. A strengthening U.S. dollar and higher borrowing costs are unnerving financial markets in developing economies, while rising trade protectionism is starting to weigh on business sentiment. Moreover, economic dynamics are softening in China and the Eurozone. On the flip side, the U.S. economy continues to fire on all cylinders, while Japan is holding up relatively well due to strong investment. A GDP growth estimate for the global economy projects year-on-year growth at 3.3% for Q3. While the print was a notch below the result from the previous period, it matched last month’s forecast. The escalation in the ongoing trade war between China and the United States topped the headlines in recent weeks. On 24 September, the U.S. enforced a 10% tariff on USD 200 billon of Chinese products, which will rise to 25% on 1 January. President Trump also warned that the U.S. will pursue additional levies on USD 267 billion of Chinese imports if Beijing retaliates against “our farmers, ranchers and industrial workers”. Nevertheless, China immediately fired back with tariffs of between 5% and 10% on USD 60 billion of U.S. goods imported into China. The direct impact of these tariffs is expected to be rather limited given that they only represent around 1.5% of global trade, while some of the production could be quickly diverted to other countries, especially in Asia. However, a worsening trade environment could have an impact on business sentiment, deterring global investment and affecting supply chains. Moreover, it could also exacerbate economic imbalances in China as authorities once again rely on investment and lending to rekindle economic growth. The recent selloff in emerging markets has stressed the vulnerability of some countries to sudden changes in capital outflows. Argentina and Turkey were particularly affected by the financial turmoil, with both countries nearing full-blown exchangerate crises, and sharp currency depreciations occurred across most developing economies ranging from Brazil to India and South Africa. That said, the consequences are expected to greatly diverge, especially hitting those with large current account deficits and/or high exposure to external borrowing.

Mounting headwinds will weigh on global growth further down the road Global economic growth appears to be losing some steam in Q3 following Q2’s strong result. A strengthening U.S. dollar and higher borrowing costs are unnerving financial markets in developing economies, while rising trade protectionism is starting to weigh on business sentiment. Moreover, economic dynamics are softening in China and the Eurozone. On the flip side, the U.S. economy continues to fire on all cylinders, while Japan is holding up relatively well due to strong investment. A GDP growth estimate for the global economy projects year-on-year growth at 3.3% for Q3. While the print was a notch below the result from the previous period, it matched last month’s forecast. The escalation in the ongoing trade war between China and the United States topped the headlines in recent weeks. On 24 September, the U.S. enforced a 10% tariff on USD 200 billon of Chinese products, which will rise to 25% on 1 January. President Trump also warned that the U.S. will pursue additional levies on USD 267 billion of Chinese imports if Beijing retaliates against “our farmers, ranchers and industrial workers”. Nevertheless, China immediately fired back with tariffs of between 5% and 10% on USD 60 billion of U.S. goods imported into China. The direct impact of these tariffs is expected to be rather limited given that they only represent around 1.5% of global trade, while some of the production could be quickly diverted to other countries, especially in Asia. However, a worsening trade environment could have an impact on business sentiment, deterring global investment and affecting supply chains. Moreover, it could also exacerbate economic imbalances in China as authorities once again rely on investment and lending to rekindle economic growth. The recent selloff in emerging markets has stressed the vulnerability of some countries to sudden changes in capital outflows. Argentina and Turkey were particularly affected by the financial turmoil, with both countries nearing full-blown exchangerate crises, and sharp currency depreciations occurred across most developing economies ranging from Brazil to India and South Africa. That said, the consequences are expected to greatly diverge, especially hitting those with large current account deficits and/or high exposure to external borrowing.

Finally, in Europe, Brexit negotiations between the European Union and the United Kingdom remain at an impasse after the Global outlook stable 2.4 2.8 3.2 3.6 Q1 15 Q1 16 Q1 17 Q1 18 Q1 19 2.9 3.1 3.3 3.5 May Aug Nov Feb May Aug 2018 2019 World Economic Growth Change in GDP forecasts Note: GDP, real annual variation in %, Q1 2015 - Q4 2019. Note: GDP, evolution of 2018 and 2019 forecasts during the last 18 months. FOCUSECONOMICS Summary FocusEconomics Consensus Forecast | 3 October 2018 European Union rejected the UK’s Chequers plan at the 20 September meeting in Salzburg. The president of the European Council, Donald Tusk, stated that Theresa May’s proposal “risks undermining the single market”. The UK prime minister now has until 18 October to present an alternative plan and the possibility of a no-deal Brexit increases as each day passes. OUTLOOK | Dark clouds gather following a bright start to the year Although global economic growth will remain resilient this year mainly due to an outstanding H1 2018 performance, dark clouds have begun to swell above the global economy. Escalating trade tensions between the United States and the rest of the world, especially China, represent the main downside risk to the global economic outlook next year. Moreover, although the global economy has been supported by stellar dynamics in the U.S. due to brash government spending and tax cuts, fiscal tailwinds will start to wane next year, which could lead to a sizable deceleration in the world’s largest economy. Despite an uncertain economic outlook, the Federal Reserve has continued to tighten its monetary policy and another rate hike is already penciled in for September. Higher interest rates in the United States are fueling volatility across the global financial markets and have triggered capital outflows from emerging markets.

In Europe, populism is still on the rise, while the long-awaited Brexit deal is still not in sight. Finally, China, which has been a key engine of the global economy over the past few decades, is facing severe challenges such as aggressive financial deleveraging and spillovers from the trade war with the United States. FocusEconomics Consensus Forecast panelists expect the global economy to expand 3.4% this year, which, if confirmed, would represent the strongest expansion in seven years. Panelists see global growth decelerating to 3.2% next year, which is unchanged from last month’s estimate. This month’s unrevised 2019 growth prospects for the global economy is the result of stable economic outlooks for the Eurozone and the United Kingdom. Meanwhile, Canada, Japan and the United States saw upward revisions to their growth forecasts. The Asia (ex-Japan) region is starting to feel the pinch from rising trade disputes, cooling growth in China and financial volatility, which is dragging on the region’s economic outlook for next year. Growth estimates for Eastern Europe are under strain owing to slowing growth in the European Union—a key trading partner— heightened volatility in the financial markets and fading fiscal stimulus in some large economies, including Turkey. While the economic outlook for Latin America for this year remains dim, next year growth should pick up as the economic recovery strengthens in key countries, especially Brazil. Despite higher oil prices, mounting geopolitical risks continue to dent growth prospects in the Middle East and North Africa. The economic recovery in Sub-Saharan Africa will gather steam in 2019 due to stronger performances by heavyweights Nigeria and South Africa.