Production is forecasted to remain above consumption. From Focus Economics: Prices fell to multi-year lows in July as Chi...

Where Is The Soybean Market Going?

Outlook is stable...FocusEconomics: Japan Recent data corroborates that the anticipated recovery in Q2 was likely weaker than expec...

Japan Economic Outlook August 2018

Recent data corroborates that the anticipated recovery in Q2 was likely weaker than expected. Subdued wage growth continues to dent consumer confidence. Industrial production, furthermore, declined in May for the first time in four months. However, with a smaller-than-expected drop in industrial production and robust export growth in June, external demand appears to be fueling activity within Japanese factories. Leading indicators for Q3 signal that economic activity will remain relatively weak, mostly reflecting mounting global economic uncertainties. The Tankan survey for manufacturers showed a less positive assessment of the country’s economic outlook as trade barriers increase globally and geopolitical risks threaten to strengthen the yen. On the upside, the 2020 Tokyo Olympics is boosting capital expenditure, providing stimulus to the economy, while the new trade deal with the European Union should support the external sector. Despite decelerating from 2017’s outstanding performance, the economy should continue to expand at a brisk pace this year, supported by the Bank of Japan’s (BoJ) ultra-loose monetary policy, a tightening labor market and construction projects related to the 2020 Tokyo Olympics. Rising protectionism globally and a sharp appreciation of the yen due to persistent geopolitical threats are the main downside risks to the outlook. FocusEconomics panelists see the economy growing 1.1% in 2018, which is unchanged from last month’s forecast, and 1.0% in 2019. Inflation stabilized at May’s 0.7% in June. Although the economy is running above potential, inflationary pressures remain subdued on the back of sluggish household consumption, and are mostly supported by higher energy prices. FocusEconomics panelists expect inflation to average 1.0% in 2018, which is unchanged from last month’s estimate. Next year, the panel sees inflation inching up to 1.2%. • The BoJ left its ultra-loose monetary policy program unchanged at its 14–15 June meeting, as expected. At the upcoming 30–31 July meeting, the Bank will release its quarterly economic review, in which the BoJ could decide to yet again push back when it expects to meet its inflation target. A large majority of our FocusEconomics panelists expect the BoJ’s shortterm policy rate to remain unchanged at minus 0.10% until at least the end of 2019. The yen has depreciated to a six-month low in recent days despite rising geopolitical tensions; the yen usually acts as a safe-haven asset during episodes of uncertainty. This time, however, widening interest-rate differentials with the U.S. likely spurred the weakening. On 20 July, the currency traded at 111.4 JPY per USD, a loss of 1.0% compared to the same day in June. Panelists see the yen trading at 109.5 JPY per USD at the end of 2018 and at 106.3 per USD by the end of next year.

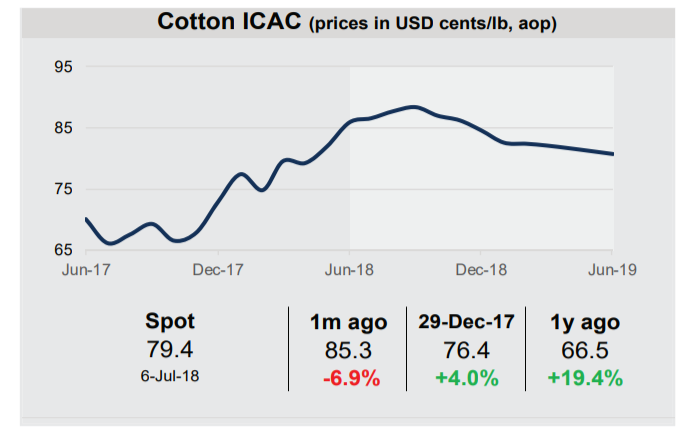

COTTON In recent weeks, prices have fallen substantially due to trade tensions. On 6 July, the spot price was USD 79.4 cents per pound, w...

Cotton & Wool Economic Prices

In recent weeks, prices have fallen substantially due to trade tensions. On 6 July, the spot price was USD 79.4 cents per pound, which was down 6.9% from the same day last month. However, the price was 4.0% higher on a year-to-date basis and was up 19.4% from the same day last year. Prices dropped recently due to concerns over the impact of the 25% tariff China imposed on U.S. cotton exports effective 6 July, which will likely lower demand. China, the world’s largest consumer of cotton, strongly affects markets, and prices are unlikely move significantly going forward. Our panelists expect prices to average USD 85.9 cents per pound in Q4 2018. In Q4 2019, panelists expect prices to average USD 79.8 cents per pound.

WOOL

Wool prices rose throughout most of June, likely on solid demand from key consumer China and tight supply. However, prices pulled back in early July as the new selling season began. On 6 July, wool traded at AUD 2,027 cents per kilogram. The print was 0.4% higher than on the same day last month and was up 15.2% on a year-to-date basis. Moreover, the price was 33.0% higher than on the same day last year. Prices are seen dipping from their elevated levels going forward, as the new season brings fresh supply to market. FocusEconomics panelists project an average price of AUD 1,675 cents per kilogram in Q4 2018. Prices are projected to ease further, to AUD 1,624 cents per kilogram, in Q4 2019.

WTI BLENDS WTI Crude Oil prices hit their highest level since November 2014 on 26 June on the back of a tightening U.S. oil market ...

Oil Economics July 2018

WTI Crude Oil prices hit their highest level since November 2014 on 26 June on the back of a tightening U.S. oil market and political tensions with Iran. In the following days, prices fell slightly, trading on 6 July at USD 73.8 per barrel. The print was up 13.9% from the same day last month and was 22.0% higher on a year-to-date basis. Moreover, the price was up 62.1% from the same day last year. Oil prices rallied from the second half of June following a soft patch at the end of May, when prices were aff ected by oversupply concerns. Since then, declining inventories in the United States and fears that the U.S.-led sanctions against Iran could reduce global oil output propelled WTI Crude Oil prices. Moreover, a U.S. economy fi ring on all cylinders is ensuring strong demand for oil. In the fi rst days of June, oil prices moved sideways, and, according to a release from 5 July, the United States unexpectedly posted a small crude build of 1.2 million barrels per day in the week ending 29 June. Moreover, U.S. President Trump is pressuring OPEC countries to pump more oil to lower prices, further rattling oil markets.

Finland's Economic Update July 2018 In the first quarter of 2018, the economy maintained its growth momentum from Q4 2017...

Finland's Economic Update July 2018

Comprehensive data confirmed that the Eurozone economy lost steam in Q1, growing at the weakest pace since Q2 2016. The external...

Euro Area Economic Update July 2018

Amid a healthy recovery and rising price pressures, the ECB announced it was winding down its massive bond buying program on 14 June, with purchases set to end completely after December. However, the Bank still struck an accommodative tone, stating that it plans to hold the refinancing rate at a record-low 0.00% until the end of next summer. The next meeting is set for 26 July. The Consensus Forecast is that the refinancing rate will end 2018 at 0.00% and 2019 at 0.30%.

The euro continued to flounder against the U.S. dollar in June, remaining at some of the lowest values seen in 2018. On 22 June, the euro bought 1.16 USD, weakening 1.2% from the same day last month. Our panel sees the currency ending 2018 at 1.21 USD per EUR and 2019 at 1.26 USD per EUR.

Italy Update Following three months of political deadlock and two unsuccessful attempts to form a government, on 6 June the...

Italy Economic Outlook July 2018

John Kemp from Reuters released a quality report today on the gasoline rise in America and national travel. In the US we have seen a shift ...

Gasoline Prices Soar

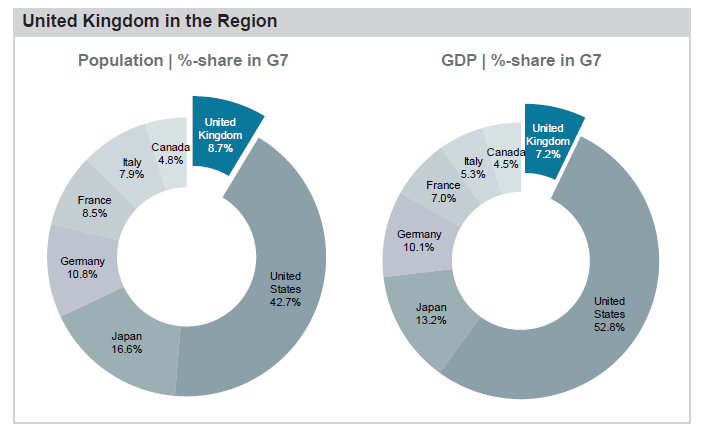

Outlook Remains Stable The economy appears to have regained some momentum in the second quarter following a weak first quarter, ...

United Kingdom Economic Outlook July 2018

According to the Nationwide Building Society (NBS), house prices in the United Kingdom fell 0.2% in May compared to the previous month in seasonally adjusted terms, contrasting April’s 0.1% increase and marking the third month-on-month price decline so far this year. On an annual basis, house prices rose 2.4% in May, down from April’s 2.6% and coming in below market expectations. The average house price in May was GDP 213,618 (May 2017: GBP 208,711). May’s tepid result comes against a backdrop of sluggish economic growth and pessimistic consumer sentiment. Going forwards, house prices are likely to continue to increase at a mild rate, underpinned by tight supply. In addition, a gradual recovery in real wages could support demand. Monetary conditions will be another key determinant of the evolution of prices. Although the Bank of England kept rates constant at its June meeting, our panelists continue to expect a rate hike this year, which would have a knock-on effect on borrowing costs.

Thank you Focus Economics for the economic reporting. Please visit Focus here.