Basically if the data had agreed... When the data does not agree you get the below... Despite Fed optimism for near-term improvement, the U....

If The Data Had Agreed

Housing starts fell in May and multi-family construction housing dropped. Single family homes went up. Housing consisted of a near .06% o...

Housing Strikes Back

"Challenges remain, including restrictive credit qualification standards and narrowing affordability. Various housing and related statistics bottomed in early to mid-2009. Since then, for a time, the on-and-off, then on-again nature of the federal housing credit spurred, or at least pulled forward, primarily entry-level buyer housing demand. With the US economy moving from recession to expansion in third-quarter 2009, plus very attractive housing affordability and government incentives, housing was jump-started. However, faltering consumer confidence, among other issues, had largely restrained the recovery. New home sales and single-family starts retested the bottom during the summer of 2010 and in February 2011. During second-half 2013, the sharp rise in home prices and interest rates and the government impasse over the budget and debt ceiling led many prospective homebuyers to take a careful stance in the shorter term. Consumer caution and poor weather from early in the year restrained the gain in housing metrics in 2014. The growth in starts, especially single-family, was more robust in 2015" - Fitch Ratings Press Release

You can ask my wife, I always wondered what went on with hotels and unused rooms. For years we lived in a major business di...

Hotel Industry Disruption

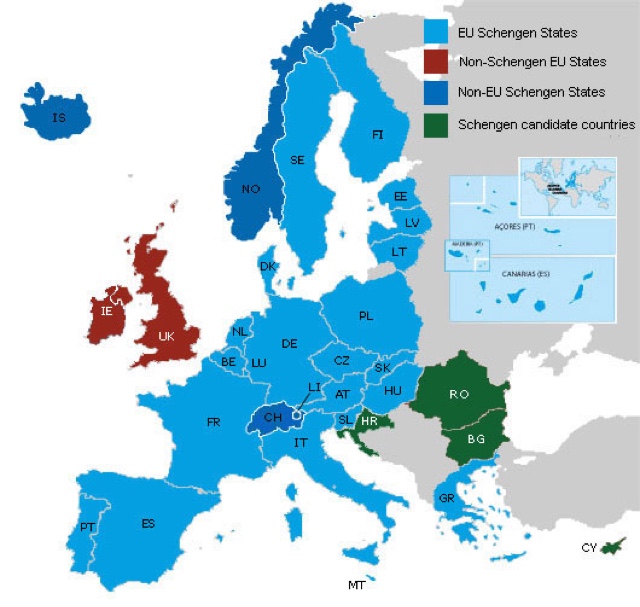

The mechanics behind an EU member state exit https://www.law.ox.ac.uk/sites/files/oxlaw/final_report_bjorge_brexit_i_0.pdf

How Does An EU Exit Work?

The Federal Reserve provided $6 million of liquidity to foreign central banks in the latest week via its swap lines for foreign central bank...

FX Swaps Last Week Cenbanks

Korea's Implied Volatility Index June 08 - June 14, 2016 - {AKA, What A Weekend} Link to published image

Korea's Implied Volatility Index

{AKA, What A Weekend}

Link to published image

- Both have somewhat tyrannical referendums on a regular basis - Both are financial hubs, filled with economists who are worried abo...

The U.K. & Swiss Have A Lot In Common

Not good. Maybe an uptick is occurring, but we need a serious uptick on silver. Many promote the industrial benefit of silver but correlatio...

Silver Spot Price w/ Dow Jones Industrial Average

New post: Flush with an influx of crude oil, independent global refiners are refining at breaking speed. Oil traders who bought at the lows...

Oil Volatility Still Going Strong

Flush with an influx of crude oil, independent global refiners are refining at breaking speed. Oil traders who bought at the lows in February ($26.01) are unloading to downstream channels. These sales should continue and will help E&P balance sheets, but only so much, as losses have greatly damaged the industry. Continued sales and revenue will repair the losses and allow for more seemingly comfortable M&A and integration.

Read more at Investing.com

Simply put, Gawker is not the New York Times, neither is the local news. Gawker, local news, and blogs need to be held accountable for dis...

Why The Demise of Gawker Works (Good For The Future)

Simply put, Gawker is not the New York Times, neither is the local news.

Gawker, local news, and blogs need to be held accountable for disrupting the standards of journalism and for endorsing mafia-like character assassination behavior. This is very similar to the news hacking scandal in London a few years back. Media must allow privacy and must adhere to a code of human ethics.

Lotte Group indicated it will shelve what may have been a $4.5 billion initial public offering for its hotel unit, the world’s biggest so fa...

Lotte To Shelve $4.5B IPO

If you value your $$$... The current won't make the fundraising hurdle and you can't get those dollars back folks. There is literall...

2016 GOP Race Will Be A Capital Waste

If you value your $$$...

The current won't make the fundraising hurdle and you can't get those dollars back folks. There is literally NO way. In fact, the current runner should consider lending himself his own money. Americans need not give in this cycle. Put your money into the economy.

CNN Park City, Utah (CNN) Republican fund-raisers are beginning to fret that Donald Trump does not comprehend the enormity of the challenge before him, warning that if he fails to execute the basic tasks of fund-raising during a critical six-week stretch...

Romney retreat puts spotlight on Trump's fund-raising problem in critical stretch

http://goo.gl/rmh2yR

A legend of venture capital has passed. I will remind myself to not make comments in old age that are so racy, but Perkins was his own...

Goodbye Tom Perkins

VW Korea what a terrible fraud against the wonderful and ancient environment of South Korea

VW Korea Fraud

Research from Torsten Sløk, Ph.D., Economist, Deutsche Bank Securities --- I continue to get a lot of questions about how to interpret Fr...

Unemployment - From DB Research

The housing bubble in mid-late 2008 ( NBER lists the beginning at 12/2007) that is often blamed for the Great Recession (GR) was in fact no...

Great Recession Caused By Fed Mistakes

Between 2005 - 2015 the beverage goons were asleep at the switch. But 2016 is a bad time to start a craft brewery. The goons are awake an...

An Unneccesary Merger Between Corporate Goons - AB InBev + SABMiller

Does anyone see a massive issue with this? Craft brew will be squeezed out and these two groups will have a global monopoly. What is my issue with this? For starters it is "just" beer. You can make beer in the bath tub, and what was once attractive (Stella, Woodchuck, Ballast Point, etc.) is now owned by corporate goons. Mega-corps cannot make craft products. Part of craft is the love of the craft, not the lust of the money behind it. Part of America is dying. These goons love destroying ideas and innovation for the benefit of their corporate jets, sponsorship of sporting events and buying private vineyards that their third wives name "Chantavia" or maybe something more terrible. Nevertheless it should be a crime, just like their hairplugs.

I have been rolling my investor eyes at Uber for a while now. That valuation - what are they thinking?? Regardless, in order to discover the...