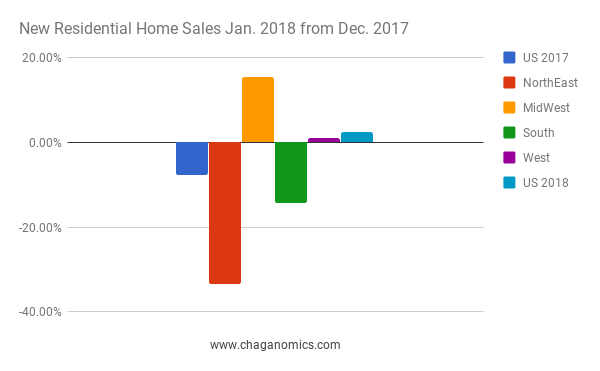

New Home Sales Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent (±19.0 percent)* below the revised December rate of 643,000 and is 1.0 percent (±16.4 percent)* below the January 2017 estimate of 599,000. Sales Price The median sales price of new houses sold in January 2018 was $323,000. The average sales price was $382,700. For Sale Inventory and Months’ Supply The seasonally-adjusted estimate of new houses for sale at the end of January was 301,000. This represents a supply of 6.1 months at the current sales rate. Read More Here.

New Home Sales Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to ...

US - New Home Sales

New Home Sales Sales of new single-family houses in January 2018 were at a seasonally adjusted annual rate of 593,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 7.8 percent (±19.0 percent)* below the revised December rate of 643,000 and is 1.0 percent (±16.4 percent)* below the January 2017 estimate of 599,000. Sales Price The median sales price of new houses sold in January 2018 was $323,000. The average sales price was $382,700. For Sale Inventory and Months’ Supply The seasonally-adjusted estimate of new houses for sale at the end of January was 301,000. This represents a supply of 6.1 months at the current sales rate. Read More Here.

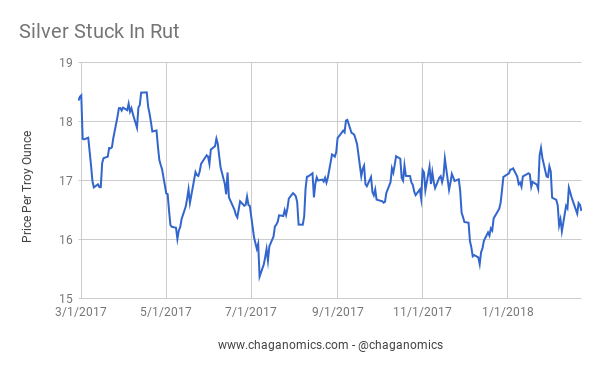

Gold and Silver - the ancient set of currency commodities - metals which many considered a form of money, and are often talked about by b...

Analysis: Silver & Gold

Quits, layoffs and discharges, other separations, and total separations, January 2007–November 2017 From the BLS: The number of tot...

Voluntary Quits 2017

Here is a link to our Voluntary Quits 2016 post.

• One year into Donald Trump’s presidency, the economy has maintained solid growth momentum in what has so far already been th...

Impact of Tax Reform (U.S. Outlook February 2018)

Inflation eased to 2.1% in December from 2.2% in November. That said, core inflation inched up to 1.8%, reinforcing market expectations of an interest rate hike at the Fed’s March monetary policy meeting. Members of the FOMC project three interest rate increases in 2018 as employment continues to rise and inflationary pressures mount. FocusEconomics panelists see inflation averaging 2.2% in both 2018 and 2019.

Monetary Analysis

Core consumer prices, which exclude volatile items including food and energy prices, rose 0.3% from the previous month in December. This came above market expectations of a 0.2% increase and followed the timid 0.1% month-on- month rise recorded in November. The print was largely driven by strong price increases for used cars and trucks, housing costs and medical care. These dynamics led core inflation to inch up to 1.8% in December from 1.7% in November. The lack of meaningful inflationary pressures, despite robust economic growth and an exceedingly tight labor market, has been at the forefront of the debate among Federal Reserve officials. In this sense, December’s stronger-than expected core inflation results are likely to reinforce market expectations of an interest rate hike at the Fed’s March monetary policy meeting. However, any additional hikes this year—the Fed’s “dot plot” currently shows three interest rate increases in 2018—will remain largely dependent on the evolution of core prices. FocusEconomics Consensus Forecast participants expect inflation to average 2.2% in 2018, which is up 0.1 percentage points from last month’s forecast. For 2019, the panel also expects inflation to average 2.2%.

Domestic economic activity appears to have lost some steam in the fourth quarter from the previous one, but remained buoyant nonethe...

Estonia Economics February 2018

This chart says it all. "Like all fiat currencies, cryptocurrencies really don’t have intrinsic value. But that doesn’t mean that ...

Has Bitcoin Burst?

"Like all fiat currencies, cryptocurrencies really don’t have intrinsic value. But that doesn’t mean that people won’t treat them as if they do, and sometimes for sustained periods of time. In fact, people have throughout history accepted things that have no value in exchange for things that do. Examples of non-government-issued currencies being used for periods of time include playing cards in the French colonies in the 18th century and limestone discs on the island of Yap centuries ago. What this means in practice is that even if a currency doesn’t have intrinsic value, it could still be used for some period of time." - Steve Strongin, Goldman Sachs Global Investment Research.

The economy continues to gather strength heading into the new calendar year, although it remains fragile, as evidenced by Dece...

Egypt Outlook Improves

The Emirates NBD Egypt Purchasing Managers’ Index (PMI) fell from 50.7 in November to 48.3 in December, signaling a worsening in operating conditions after briefly moving into positive territory for the first time in over two years in the prior month. December’s decrease was driven by contractions in output and new orders both at home and abroad. On the positive side, despite subdued activity, the rate of job shedding reached a 28-month low, likely thanks to strong business confidence regarding future growth prospects. Firms’ sentiment was underpinned by increased capital expenditure and expected future economic stability. On the price side, input price inflation eased to a near two-year low, while the rate of output price inflation also dipped.