The Securities Law Blog: Finra fines Lincoln Financial broker-dealer $650,0... : Didn't we do this already? FINRA fined Lincoln Financ...

The Securities Law Blog: Finra fines Lincoln Financial broker-dealer $650,0...

Good read. Love this blog. - Chad Hagan

Full Article, Reprint From Lexology On November 17, 2016, the Internal Revenue Service (IRS) filed a Petition for Leave to Serve a John...

IRS Sinks Subpoena Teeth into Virtual Currency as Taxable Property, Seeks Coinbase's Transaction Records - Venable LLP

Full Article, Reprint From Lexology

On November 17, 2016, the Internal Revenue Service (IRS) filed a Petition for Leave to Serve a John Doe Summons (subpoena) on Coinbase in the in U.S. District Court for the Northern District of California. The IRS's position is that a large number of taxpayers, many of them holding Coinbase accounts, have not paid tax on gains from trading in virtual currencies, defined as property by the IRS (IR-2014-36, March 25, 2014). The subpoena requests all records of virtual currency transactions by U.S. persons from January 1, 2013 to December 31, 2015. Coinbase reports to have 4.9 million users worldwide. The petition is based on the authority granted to the IRS in 26 U.S.C. 7609(f). This allows the IRS to request a court to issue a subpoena to third parties for information relating to an unknown individual (John Doe) or unknown class of individuals. In order to prevail, the IRS must establish that: The summons relates to the investigation of a particular . . . group or class of persons; There is a reasonable basis for believing that the group may fail or may have failed to comply with "any internal revenue law"; and The information sought is not readily available from other sources. The IRS's petition is supported by a declaration by Senior Revenue Agent David Utzke that focuses on meeting each of the IRS's three burdens. The declaration is a primer on virtual currencies, how they are bought and sold, tax compliance requirements, and Coinbase. This is all before Agent Utzke explains how the John Doe summons requirements are met: The particular class of persons are "particularized from the general public" by being U.S. "persons who transacted in a convertible virtual currency"; The IRS's "reasonable basis for believing that the group may fail . . . to comply" with IRS laws is grounded on three lines of reasoning: Tax noncompliance increases in the absence of third-party information reporting, which is the case here; In Agent Utzke's experience with virtual currency in IRS cases, each taxpayer has concealed the existence of a virtual currency account; and The information and experience of the IRS "suggests that many unknown U.S. taxpayers engage in virtual currency transaction or structures." The requested materials are not readily available from other sources because, although the blockchain on which the virtual currency transactions take place is public, the blockchain does not record information that identifies the parties to the transactions. In this case, only Coinbase has that information. The petition to issue the subpoena follows the release of a report by the Treasury Inspector General for Tax Administration (TIGTA) calling for additional action to ensure taxpayer compliance with regard to virtual currencies. (TIGTA, As the Use of Virtual Currencies in Taxable Transactions Becomes More Common, Additional Actions Are Needed to Ensure Taxpayer Compliance, Reference Number 2016-30-083, Sept. 21, 2016) Coinbase has responded that it will oppose the petition in court. The statistical evidence, however, indicates that the IRS is likely to prevail...

END ++

Link w/ Data & Image The above charts shows a forecast. The RED line is the Fed's 5 Year Forward Rate, the BLUE line s...

Forecasting Trumponomic Inflation

Link w/ Data & Image

The above charts shows a forecast.

The RED line is the Fed's 5 Year Forward Rate, the BLUE line shows a forcast of .5% inflationary growth per year over the next few years, begining next year. This is NOT a stretch (2011-2012 inflation rate increased from 1.94 to 2.45% alone). In June, consumer prices increased 1.7% over the previous month alone in Nigeria, according to the National Bureau of Statistics. Granted, the US does not have such inflation volatility.

Here are a few factors to think about:

1. A crack down on illegal workers will (or could) stress the hourly wage index

2. Infrastructure Spending (To be frank: Multi-Trillion Dollar Infrastructure Spending)

3. Trade Isolationism, Increased Import Tariffs, Export Losses

The above situations are already on the agenda. Of course a level of inflation is always there, but I am curious if the above chart is coservative. The chart below has an exponential trendline (in green) showing the uptick from the CPI time series monthly data.

Let us not forget the great inflation of the 1970s, which lasted late 1972 - the early 1980s. Professor Jeremy Sigel, called it: the greatest failure of American macroeconomic policy in the postwar period.

From November 14th, 2016 - We’ve had a sentiment shift in the bond market. We’ve seen it, too. People have already started reallocating out of bonds and into stocks. - Jeffrey Gundlach, CEO of DoubleLine Capital.

See link - Trump Thump whacks bond market for $1 trillion loss.

From an economic perspective, ending trade and "making" corporations stay in the country is not the...

Increasing Disposable Income In The US

From an economic perspective, ending trade and "making" corporations stay in the country is not the right move. Nor is printing more money. This is slowest US recovery on record...But we don't need to become ethno-nationalistic isolationists.

What will continue to create more disposable income and more jobs for the middle class?

To stimulate the economy, the United States and governments worldwide have pursued economic policies, including low interest rates, that have increased the possibility of higher inflation. Like stock prices and interest rates, future inflation is unknown. Therefore, positioning your portfolio to weather various inflation scenarios is a smart move. Although there are effective strategies to counter its corrosive effects, no single investment serves as a reliable hedge in every inflation environment because other powerful forces such as interest rates are simultaneously at work. - John SpotoRead More From The Lowell Sun - http://www.lowellsun.com/business/ci_30608423/protectinginvestments-from-inflation#ixzz4REJjbU1w

Trumpism Has Dealt Economics A Fatal Blow:

https://www.ineteconomics.org/perspectives/blog/trumpism-has-dealt-a-mortal-blow-to-orthodox-economics-and-social-science

Slowest US Recovery On Record: http://www.fool.com/investing/2016/11/27/yes-this-is-the-slowest-economic-recovery-and-that.aspx?source=iedfolrf0000001

Link to chart image published to Google - https://docs.google.com/spreadsheets/d/e/2PACX-1vS3MLwX_pw6TjT6LJCdtl2onqXLVKCufwbXNdo8lvJIohhrM0Y5Q8MVip2HYeHnvSLu2DMtz5Mt9H74/pubchart?oid=1349991098&format=image

If the USA steps out of TPP (as the graphs depict) other trade blocs: APEC and RCEP - will pick up the pace and cover the gaps. How Many...

Trade Deals - Regional Comprehensive Economic Partnership (RCEP), Asia Pacific Economic Cooperation (APEC), Trans-Pacific Partnership (TPP)

If the USA steps out of TPP (as the graphs depict) other trade blocs: APEC and RCEP - will pick up the pace and cover the gaps.

|

| How Many Deals? Green = 3, Orange = 2, Red = 1 www.zermattresearch.com |

Regional Comprehensive Economic Partnership (RCEP), Asia Pacific Economic Cooperation (APEC), Trans-Pacific Partnership (TPP).

I remember those high flying altcoin days. So much speculation about who was using the currency in bulk: drug dealers, crime syndicates, inv...

IRS: Coinbase We Need Your Client Records

Ag % - all over the place...

Zermatt Ag Prices - www.zermattresearch.com

While USD is wrapping up its best week in a year the MXN peso has taken a continued beating . Investors are worried if and how Trump polici...

Mexican Peso Slide Will Continue

While USD is wrapping up its best week in a year the MXN peso has taken a continued beating.

Investors are worried if and how Trump policies could effect exports from Mexico, the No. 2 economy in

Latin America, driving the peso lower and creating expensive money for Mexico.

While the Peso hit an all time low, Mexico's 30-Year bond had a spike. So far credit ratings have not been effected, but it is too early to tell. Mexico's credit rating was moved to negative in March of this year by Moodys, moving down from stable. Moody's did not mention the US election as a risk but stated: "Subdued economic performance and continued external headwinds will challenge the government's fiscal consolidation efforts and increase the risk that rising debt ratios will not stabilize over the rating horizon."

Meanwhile the peso slid against the Israeli Shekel (ISLMXN) and the Singapore Dollar. While both pairs are a tad exotic, it is significant and fully represenative of the global slide of the Mexican Peso.

Mexican Peso margin requirments in Canada have increased, brought on by a loss in value and more risk. The IIROC (Investment Industry Regulatory Organization of Canada) released a statement today after the currency continued a negative streak incuding a 12% drop against the dollar over the past 48 hours.

Much of the concern is from uncertainty. If Trump dismantles NAFTA the peso will stay supressed. However, this is too early for analysis and is pure speculation at this point. NAFTA could be renegotiated but many of the current business is locked in with public companies and North America's precious (but flawed) GDP measurements.

T.P.P. could continue without the U.S and Mexico could join trade talks with other sovereigns so as to avoid negative speculation and continued pressure on their economy. Trump is against the T.P.P agreement and Mexico stands to benefit heavily from the 12-country deal, comprising the United States, Singapore, Australia, Brunei Darussalam, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, and Vietnam. The Ag industry wants T.P.P. but Trump and his GOP cohorts are against it. It will not happen during the lame duck session, meaning it will not be brought up this year. It is no secret that Mexico was counting on the continued success of NAFTA and the development and deployment of the T.P.P. deal, these outlooks will sideline immediate GDP growth and continue uncertainty for the Mexican economy.

There was a spike...

Mexico 30-Year Bond Yield (3 Month Snapshot) - www.zermattresearch.com

The Trump victory is essentially Brexit Two, or perhaps more apropos: the US Brexit. Despite the turmoil of election night, most lo...

The Black-Swan Event That Could Lead To Inflation

Despite the turmoil of election night, most losses will not sustain.

Arguments can be made that the spikes with ES & GC were due to hedges in place in case of a black swan event. I was asleep at the switch on Trump; I expected a catastrophic GOP loss. However, it does seem that we overreacted to the idea of Trump and - despite it being early - the US markets are not taking hits like Brexit.

Trump is a real estate guy and he may make the right moves. He is not an economist, technologist or a lawyer, but he does know how nuts and bolts industry work (to a degree). I imagine that he will stick to the age old tip of choosing people smarter than yourself, and choosing the smartest person for the job. Let's hope he has goals in sight because he has the ability to pick the greatest group of economic and public policy advisors ever seen. If that is the case then America will turn around. I do not see how we can kickstart deceased industry in the rust belt, and this leads one to think of trade wars, but commodities could be sourced from US suppliers with some increased costs, and America could rebuild + add jobs. Investors and underwriters would need to be willing to pay the premium to rebuild America, and trends show support, especially now. Trump could mandate a municipal bond underwriting trend to rebuild America and we could have a repeat of the 1950's, including a new baby boomer generation, a striving middle-consumer class and bubbles...

This is just one scenario out of many that I envision coming into effect over the next few years. There is no doubt we need infrastructure rebuilding and reinvestment into our country. Private employment hiring is expanding, but will this lead to inflation and or significant pricing bubbles brought on by over investment and over supply?

Here is a quote + chart from Torsten Sløk, Chief International Economist @ Deutsche Bank Securities: "I’m getting many questions about the potential for a significant fiscal expansion and what it means for growth, inflation, and the Fed. The chart below shows that construction worker wage growth is already near 2006-2007 levels and hiring more infrastructure workers for government projects is going to put even more upward pressure on wage inflation."

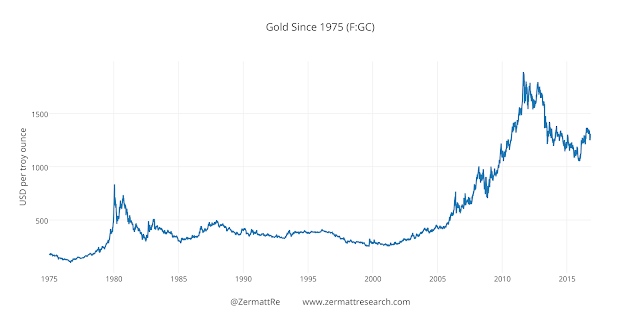

Gold Since 1975 (F:GC) Thank you Zermatt

Gold Since 1975 (F:GC) 1975 - Today Gold Chart

You see some def. spikes, but then it's back...The Trump reversion to the mean? A debt bomb which soothes over with a tranquil chat at ...

Brent Crude Election Night

F:GC - Spot Gold Snapshot from Zermatt

Always enjoyable digging deep in these deals. "Last week, the State of Wisconsin Building Commission, a seven-member board chaired b...

Wisconsin Building Commission Approves Multiple Infrastructure Projects - Muni News

"Last week, the State of Wisconsin Building Commission, a seven-member board chaired by Governor Scott Walker, approved several infrastructure projects, which can now move on to the next stage toward implementation. The membership of the Commission consists of three State Representatives, three State Senators, and a citizen member.

Renovation of the Towers Residence Hall at UW-Eau Claire – $33 million This project renovates both ten-story Towers Hall Renovation wings to provide additional common areas, and improve resident rooms, bathrooms, and hallways to meet current standards, and other improvements. The Towers Residence Hall was constructed in 1966, and has not been remodeled since the original occupancy.

Renovation of the Witte Residence Hall at UW-Madison – $47 million A major renovation to this building over a two-year span to address mechanical issues, improve the resident spaces, and upgrade the facilities. New, expanded bathrooms will be created on each resident floor.

The final phase of the Falcon Center for Health Education and Wellness project – $1.1 million The project work in this final phase will include abatement of hazardous materials, relocation of a sewer pipe under the Nelson Building, and removal and termination of all building utilities. These buildings will be vacant when the Falcon Athletics Department and Health and Human Performance Department relocate to the new Falcon Center for Health, Education, and Wellness upon its anticipated completion in September 2017"

Here is a list of additional approvals - LINK

What is the commission? The State of Wisconsin Building Commission was created 1949 to oversee the planning, improvement, major maintenance and renovation of state facilities. In 1969, following a constitutional amendment that allowed the state to directly issue debt, the powers and responsibilities of the Commission were enlarged to include the supervision of all matters relating to the contracting of public debt. Here is a link.

I will say that in 1916 $400.00 was worth $8,800.00+ in 2016 dollars - Chad ++ From MacroTrends

100 Years of Gold Bullion Troy Oz

On October 28th of this year this US Supreme Court (SCOTUS) granted a petition to hear the case: Kindred Nursing Centers Limited Partnershi...

Kindred Healthcare Skilled Nursing Case Goes To SCOTUS Over Arbitration Agreements

On October 28th of this year this US Supreme Court (SCOTUS) granted a petition to hear the case: Kindred Nursing Centers Limited Partnership v. Clark.

The buzz in the skilled nursing industry is that SCOTUS is going to shut down arbitration.

CMS has also issued a new anti-arbitration rule - before the SCOTUS review and decisions - that bars any nursing home that receives federal funding from requiring that its residents resolve any disputes in arbitration, instead of court. In what seems to be a mixed set of reviews and opinions, operators are either accustomed to not using and therefore not enforcing arbitration, or the opposite: they use arbitration all the time. I have heard first hand that the CMS rule bars any mentioning of voluntary arbitration as well. Larger corporations use arbitration for a wide array of reasons, and this ruling will add millions in additional costs to the bottom lines of public equity post-actute groups like:

KND ,ENSG, ADK, GEN, CSU, PBD and PUW and others. When lawsuits go to a jury they can easily upend an operator with millions of dollars in legal fees per case.

This could not come at a worse time (optically) as REITs have moved to shed SNF assets due to perceived cut backs from CMS and reimbursement risk and the fact that tenents are looking more default ready than even before. Many of these SNFs can be attributed back to municipal debt bonds.

The NYTimes on 9/28/2016 published:"With its decision, the Centers for Medicare and Medicaid Services, an agency under Health and Human Services, has restored a fundamental right of millions of elderly Americans across the country: their day in court."

Of course the elderly need their day in court, and bad operators need to be shut down. However, with the Five-Star Quality Rating System from CMS, notable Grade-A private-pay SNF's receive low ratings and low level stars when they are in fact trending up and by internal standards doing very well.

Facts persist: SNF and post-acute facility economics are better for the state and federal budget than full time staff or independent living with home health. However, customization and effective advocacy is the key. Simple issues need to be taken to reduce risk and prevent abuse to residents like pharmacology, 24/7 monitoring of vitals, data integration and in-room patient video cameras and additional staff.

Perhaps most is interesting is that unless SCOTUS "singles out" this ruling and states they are in favor of the CMS ruling in this instance, but not for arbitration as a whole, the SNF - nursing home industry is going to be the catalyst to a 7th Amendment advocacy call against citizens who have been refused their 7th Amendement right from the 1926 Federal Arbitration Act. The FAA supports a compulsory and binding arbitration contractual agreement, an arbitration award and a contractual agreement to forgo any appeals to a court. Senator Al Franken is reintroducing his bill: Arbitration Fairness Act of 2015, which bars mandatory arbitration agreements.

Here is the Kentucky's Supreme Court ruling - Link

From Erica Tiechert at ModernHealthcare.com: According to Kentucky's Supreme Court, it would be "strange" to allow an individual to waive another's rights through a binding contract. The state court determined the residents would have needed to specifically agree to hand over power of attorney for arbitration agreements in order for the disputed arrangements to be valid. Clark and Wellner both had power of attorney for their parents when they signed the disputed contracts, Kindred says.